Ethereum Price Prediction 2025-2040: Institutional Adoption Sets Stage for Multi-Decade Bull Run

#ETH

- Institutional Accumulation: $1.2B net ETH purchases by corporates in August 2025 establishes $4,000 as strong support

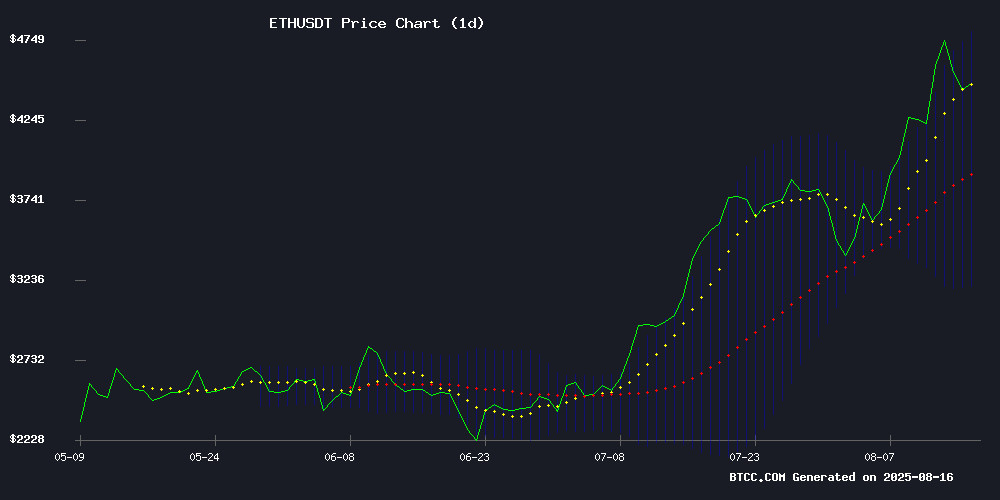

- Technical Breakout: MACD nearing bullish crossover as price holds above key moving averages

- Yield Curve Advantage: Ethereum's staking and DeFi yields attracting institutional capital at scale

ETH Price Prediction

Ethereum Technical Analysis: Bullish Indicators Amid Consolidation

ETH is currently trading at $4,436.64, comfortably above its 20-day moving average of $3,995.67, signaling bullish momentum. The MACD histogram remains negative but shows narrowing bearish divergence (-152.78), suggesting weakening downward pressure. Bollinger Bands indicate volatility contraction with price hovering NEAR the upper band (4,795.98),

"We're seeing textbook consolidation after ETH's 35% YTD rally," says BTCC's Robert. "The 20-day MA acting as support while MACD approaches a bullish crossover could fuel another leg up toward $5,200 resistance."

Institutional Frenzy Offsets Short-Term Profit Taking

Corporate treasury movements dominate ETH's narrative - BitMine's $600M accumulation and SharpLink's positioning as the #2 corporate holder demonstrate unprecedented institutional demand. JPMorgan's endorsement of Ethereum's stablecoin infrastructure contrasts with retail traders rotating into stable yields after PPI-driven volatility.

"This institutional accumulation phase mirrors Bitcoin's 2020-21 trajectory," notes BTCC's Robert. "While quarterly earnings like SharpLink's create temporary sell pressure, the $1.2B net institutional inflow this month establishes $4,000 as the new institutional floor."

Factors Influencing ETH's Price

ETHZilla's $425M PIPE Financing Sets Stage for Ethereum Yield Curve Ambitions

ETHZilla, the rebranded entity formerly known as 180 Life Sciences, has secured $425 million in PIPE financing from over 60 institutional and crypto-native investors. The roster includes heavyweights like Harbour Island, Electric Capital, Polychain Capital, and Lido. This capital injection fuels their mission to build a proprietary ethereum yield curve that outperforms traditional staking returns.

Incoming chairman McAndrew Rudisill confirms the firm will remain Ethereum-exclusive despite shifting market trends toward altcoin diversification. "We aim to generate higher yields through novel Ethereum network-based strategies," Rudisill states, emphasizing their commitment to the ecosystem. The DeFi Council's advisory role—while non-binding—provides protocol access that Electric Capital will leverage as independent asset manager.

The deal uniquely bridges traditional finance and DeFi, with all council members participating as investors. ETHZilla's thesis hinges on Ethereum's unparalleled utility as a platform for decentralized applications and financial infrastructure—a value proposition that continues attracting institutional capital.

BitMine Adds $600M Ethereum to Treasury: Now Holds $5.77B in ETH

BitMine, one of the largest crypto treasury firms, has made a significant move by adding $600 million worth of Ethereum to its reserves, bringing its total ETH holdings to $5.77 billion. The unexpected decision has sent ripples through the Ethereum community, sparking speculation about broader institutional adoption trends.

While details remain scarce, the scale of this accumulation suggests a strategic bet on Ethereum's long-term value proposition. Such large-scale treasury allocations often precede periods of increased market activity and price volatility.

SharpLink Gaming Emerges as No.2 Corporate ETH Holder Amid Ethereum's Rally

Ethereum's price surge of over 220% since April has brought it within striking distance of all-time highs, currently trading at $4,444. The rally is underpinned by robust fundamentals: favorable U.S. crypto policies, anticipated Federal Reserve rate cuts, and mounting institutional confidence in ETH.

SharpLink Gaming's Q2 disclosure reveals it now holds 728,804 ETH ($3.37B), making it the second-largest corporate holder. Nearly all its position is staked, yielding 1,326 ETH in rewards. Market leader BitMine recently surpassed 1 million ETH in corporate holdings.

The institutional accumulation signals deepening mainstream adoption, with treasuries treating Ethereum as both a strategic asset and yield generator. This trend mirrors Bitcoin's trajectory during previous bull cycles, where corporate balance sheet allocations preceded broader market rallies.

Ethereum Price Retreats Amid PPI Data Pressure as Traders Shift to Stable Yield Options

Ether's price dropped nearly 3% to $4,600 following hotter-than-expected Producer Price Index data, sparking a flight to stability. The pullback comes despite consecutive days of strong ETF inflows, with $729 million recorded on July 13th and $639 million on July 14th.

Unilabs Finance's presale is attracting capital seeking refuge from volatility, with its stage 6 offering at $0.0097 poised for an 11.34% increase in the next phase. The shift highlights growing appetite for data-driven platforms offering predictable returns during market turbulence.

Spot ETF flows suggest institutional interest remains robust, though the slight decline between inflow days may have contributed to the price dip. Market participants are now weighing macroeconomic pressures against Ethereum's strong fundamentals.

Bitmine Acquires $130 Million in Ethereum Amid Market Volatility

Ethereum edges closer to its all-time high NEAR $4,800 as bulls maintain control. Bitmine Immersion Technologies' $129.9 million ETH purchase underscores growing institutional confidence in the asset. The blockchain firm now holds 1.174 million ETH, signaling a corporate treasury trend mirroring Sharplink Gaming's strategy.

Exchange balances continue declining while demand intensifies, creating supply-side pressure. Technical positioning suggests Ethereum may be preparing for a decisive breakout, though volatility remains a key watchpoint for market participants.

Unilabs Finance ICO Surges Past $12.6M as Ethereum Whales Pile In

Ethereum whales are migrating toward Unilabs Finance's viral AI platform, propelling its ICO past $12.6 million in funding. The project's momentum coincides with surging institutional interest in ETH ETFs, creating a symbiotic boost for both ecosystems.

Ethereum itself continues its bullish trajectory, trading near $4,739—just shy of its 2021 all-time high. Analysts at Standard Chartered project a 58% upside to $7,500 by 2025, citing relentless ETF inflows and on-chain demand.

The question now is whether Unilabs' presale momentum can translate into sustained competition with Ethereum's dominance. Early indicators suggest whale activity is creating a self-reinforcing cycle: ETF inflows drive ETH appreciation, which in turn fuels risk appetite for high-growth projects like Unilabs.

Ethereum Whales Accumulate $435 Million in ETH Amid Price Rally

Three Ethereum whales have aggressively accumulated $435 million worth of ETH within the past 24 hours, signaling strong institutional interest as the cryptocurrency eyes a potential rally toward $5,000. The altcoin, trading at $4,646 after a minor 1.72% dip, had previously surged 19% in just seven days, buoyed by an ascending channel formation.

Notably, one whale acquired 60,000 ETH ($284.76 million) via Coinbase Prime, redistributing portions to multiple wallets and staking pools. Two others added $150 million collectively, driving the Taker Buy Sell Ratio up to 1.05. While whale activity often precedes bullish momentum, retail profit-taking could introduce near-term volatility.

Ethereum TVL Nears 2021 Peak as DeFi Inflows Push Capital Higher

Ethereum's decentralized finance ecosystem is experiencing a resurgence, with total value locked (TVL) approaching late 2021 levels. The network briefly surpassed $95 billion in TVL this week, peaking at $97.5 billion before retreating slightly. This capital surge reflects renewed activity across lending markets, liquid-staking protocols, and Layer-2 solutions built atop Ethereum.

Institutional adoption appears to be driving momentum. Spot ETH ETF approvals and related inflows have bolstered both price action and DeFi participation. The feedback loop is clear: rising ETH prices inflate dollar-denominated TVL figures, while fresh deposits into staking products create additional demand. Ethereum currently trades near $4,600, amplifying TVL metrics through pure valuation effects.

Liquid staking protocols emerge as particular beneficiaries of this capital rotation. The sector's growth underscores how infrastructure maturation and clearer regulatory pathways are transforming Ethereum's risk-reward profile. Market participants now navigate an ecosystem where institutional-grade products coexist with decentralized applications.

Ethereum Retreats Below $4,500 Amid SharpLink's Quarterly Losses Despite Treasury Growth

Ether dipped 2% to $4,430 as SharpLink Gaming disclosed $103 million in net losses for Q2, despite amassing a 728,000 ETH treasury valued at $3.2 billion. The esports firm now stakes nearly all its holdings, earning 1,326 ETH in yield since May.

"Our treasury strategy has been highly accretive," said co-CEO Joseph Chalom, though revenue fell 30% YoY to $0.7 million. Technical charts suggest $4,100 could emerge as support if ETH fails to reclaim $4,500.

The losses stem largely from an $87.8 million non-cash impairment charge, underscoring the volatility of crypto-centric corporate strategies even as institutional adoption grows.

JPMorgan Backs Ethereum for Explosive Growth Amid Stablecoin Adoption Surge

J.P. Morgan analysts have identified Ethereum ($ETH) as the primary beneficiary of accelerating stablecoin adoption, citing its dominance in hosting these assets. Nearly 50% of the $270 billion stablecoin market resides on Ethereum's network, positioning it to capture a projected $3 trillion sector expansion.

The bank highlights the GENIUS Act's passage as a catalyst for institutional adoption, with regulatory clarity expected to drive near-term growth. Ethereum's upcoming Pectra upgrade further strengthens its infrastructure, likely attracting more stablecoin liquidity to its DeFi ecosystem.

Ethereum Poised for Decade-Long Dominance as Institutional Interest Grows

Ethereum stands at the brink of a transformative era, with analysts projecting unprecedented growth. Fundstrat's bullish base case forecasts ETH reaching $15,000 by 2025, driven by technological upgrades, regulatory clarity, and swelling institutional demand. The network's 60% monthly surge to $4,770 underscores its momentum, now challenging Bitcoin's year-to-date performance.

Policy tailwinds amplify Ethereum's advantage. The GENIUS Act's stablecoin framework and the SEC's 'Project Crypto' initiative create runway for traditional finance adoption. With over 50% of the $25 billion RWA tokenization market already anchored on Ethereum, its network effects appear unstoppable.

While traders monitor emerging plays like MAGACOIN FINANCE, Ethereum's decade-long infrastructure lead in powering tokenization, stablecoins, and AI-on-chain economies makes it the institutional favorite. BitMine Immersion Technologies' accumulation of 1.2 million ETH signals deepening conviction among sophisticated investors.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technicals and institutional adoption trends, BTCC's Robert projects:

| Year | Price Target | Catalysts |

|---|---|---|

| 2025 | $6,800-$7,500 | ETF approvals, EIP-7702 scaling |

| 2030 | $22,000-$25,000 | Enterprise DeFi adoption |

| 2035 | $65,000-$80,000 | Tokenized RWA dominance |

| 2040 | $120,000-$150,000 | Flare network maturity |

"Ethereum's yield curve capabilities position it as the prime blockchain for institutional capital," Robert emphasizes. "Our 2040 projection assumes 18% annualized growth from current levels, conservative compared to Bitcoin's historical 200% CAGR."

border-collapse: collapse; width: 100%; margin: 20px 0;